Impact of Covid-19 on the UK labour market: The case for a place-based recovery

Posted on

This long read is a collaboration between Cambridge Econometrics and The Work Foundation.

The Covid-19 crisis has had a huge impact on the national economy and labour market

The Covid-19 crisis has had a huge impact on the UK economy and labour market. At its peak in April 2020, 31% of eligible jobs were furloughed. By January 2021, unemployment had risen to 5%, which is the highest it has been since 2016 and yet not nearly as high as it might have been without Government support.

Local impacts have been diverse and are cause for concern

The national economic performance during the pandemic has been a cause for significant concern, but hides the uneven spatial impacts of Covid-19 which will have serious long-term consequences for some local economies.

This long read explores the distinct experiences and potential routes for recovery in the three local authority areas with some of the highest take-up rates of the Coronavirus Job Retention Scheme (furlough) in England: Eden in Cumbria, Crawley in West Sussex and Haringey in North London. As our analysis shows, there are risks of potential long-term impacts on GVA and jobs.

We then go on to discuss potential national and local-level measures which could support local areas to facilitate growth in quality, secure and well-paid jobs through the recovery.

2020 witnessed the highest rate of contraction in GVA in the past 100 years, whilst employment has managed to escape such losses due to the government’s policy response

GVA (economic output) in the UK fell by an unprecedented 9.4% (£164 billion) in real terms during 2020, according to new Cambridge Econometrics analysis. This was double the contraction resulting from the 2008-09 financial crisis.

In contrast with the sharp fall in GVA, employment has been relatively resilient. The decline in jobs during this crisis has to date reached only one-fifth of that experienced during the early 1990s recession (386,000 vs 1.9 million).

The Coronavirus Job Retention (furlough) Scheme combined with grants and loans for businesses has enabled employers able to retain workers, further aided by the prospect of a swift return to normal activities over the summer.

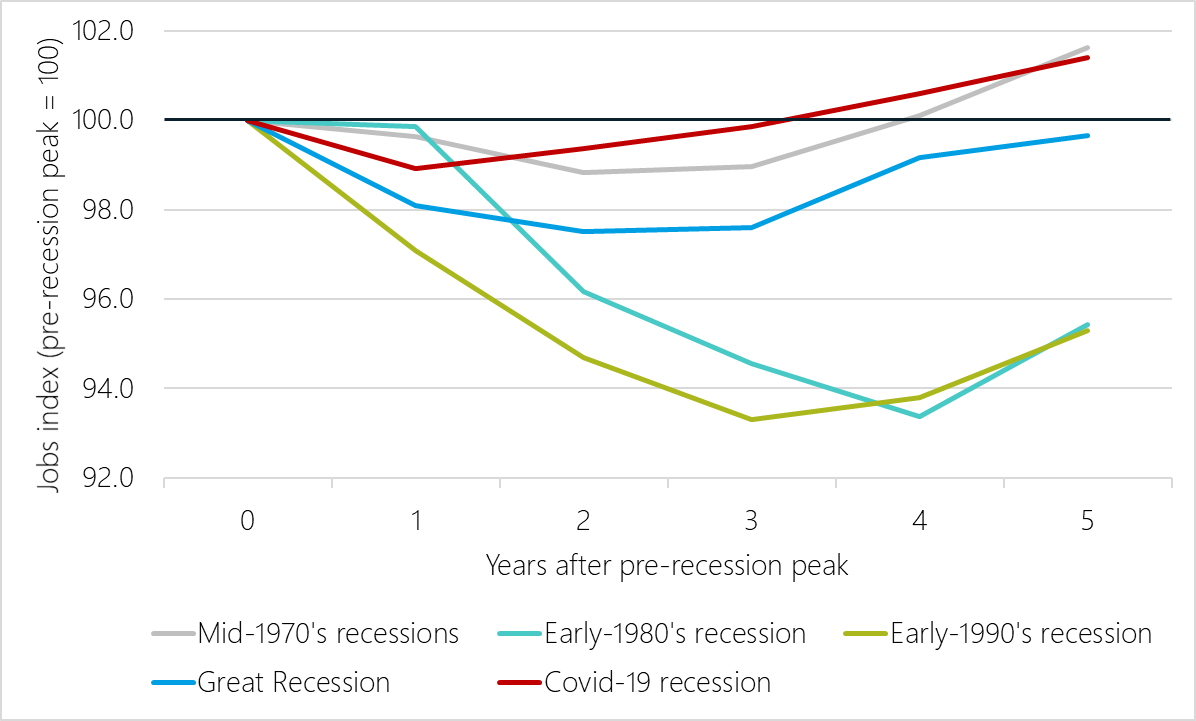

Cambridge Econometrics forecasts support this, expecting employment to return to pre-Covid levels by 2022, one-year before GVA recovers. This would make the post-Covid labour market recovery one of the strongest since the recovery from the mid-1970’s recession.

Figure 1: Comparison of job recoveries following previous crises

Source: Cambridge Econometrics, 2021

Sectors that were forced to shut during lockdown have been impacted the most

Although the crisis has affected the entire economy to some degree, the impacts and potential for recovery varies across sectors. Provisional furlough statistics for the lockdown starting in January 2021 indicate that 68% of jobs in accommodation & food, 64% in arts and entertainment and 52% in retail were furloughed, which makes these the worst impacted sectors.

Conversely, other sectors have been less reliant on furlough, and some have even grown their workforce. Health and public administration created an additional 374,000 jobs over 2020, largely to help manage and oversee the response to the pandemic. Other sectors have grown as a result of accelerated demand, such as real estate, online retail and distribution, IT services, and finance.

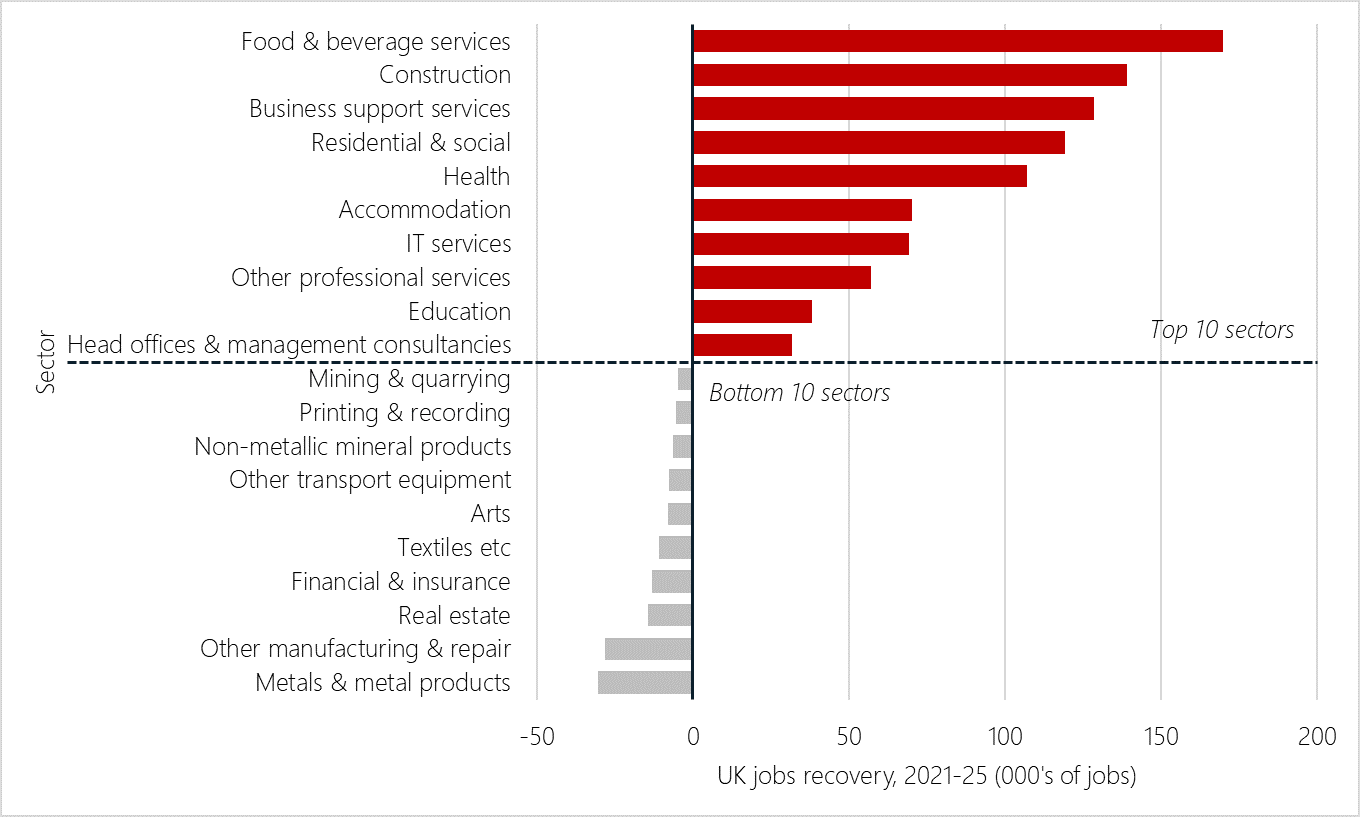

There is a mixed picture for recovery amongst industrial sectors

The graph below indicates forecast change in workforce size by sector between 2021 and 2025. The downsizing in manufacturing and production that was already in train has been accelerated as a result of the crisis, alongside Brexit headwinds. Other sectors that have been particularly affected by lockdowns including retail, leisure and tourism are expected to experience a rapid recovery once restrictions ease and consumer demand picks up over a sustained period.

Figure 2: Projected recovery in jobs 2021-25, by sector

Source: Cambridge Econometrics, 2021

Sectors less affected by the crisis could experience strong growth over the years ahead such as construction, IT and professional services. This is reflected through our place-based analysis, which indicates that the distinctive sectoral composition of the areas we focus on determine the ways in which the recovery is expected to play out.

There is a real risk that the economic recovery will see the restoration of many insecure, low paid jobs, and will do little to address the concerns of job quality and insecurity that emerged in the decade after the 2009 recession

It is important to think about the recovery not only in terms of the number hour worked or jobs added, but also in relation to the quality of jobs that are being created in the wake of the crisis. The 2009 financial crisis was followed by a large increase in the number of insecure, low-paid jobs, which can be harmful for workers’ long-term employment and wage prospects, and even their physical and mental health. Since then, active labour market policy has been characterised by welfare conditionality and limiting income replacement in benefits to one-fifth of in-work pay.

While employment levels had reached a record high prior to the Covid-19 crisis, we also saw zero-hour contracts increase from 0.4% in 2010 to 3.2% in 2019, and the proportion of workers in poverty having increased from 9.9% to 12.7% over the past two decades, while overall wage levels only returned to pre-2008 levels during 2019. In addition, a large body of evidence indicates that employment support wasn’t meeting the needs of individuals further away from work. Recent years have seen commentators from all political backgrounds emphasising the need for personalised employment support, with a focus on outcomes related to work, rather than reducing benefit caseloads.

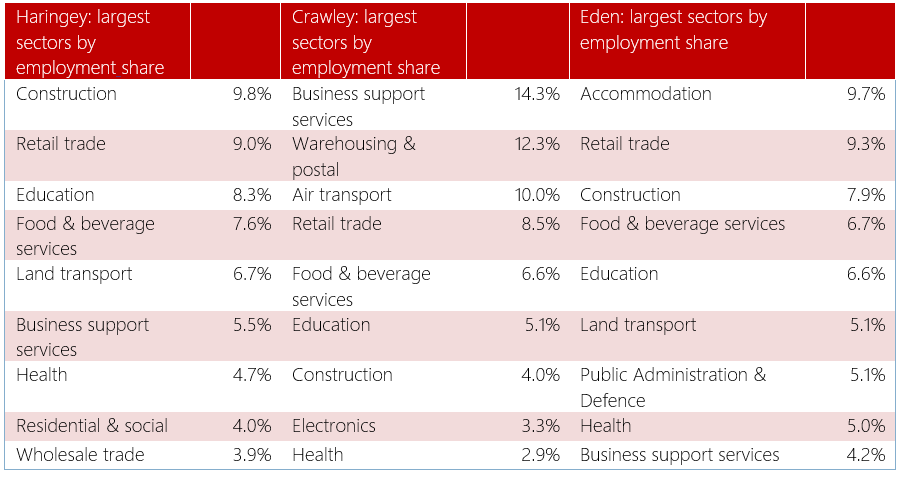

The impact of Covid-19 on three local economies

The short- and long-term impacts of Covid-19 on different places will be strongly related to the sector-mix of their local economy. To illustrate this, we can look more closely at three very different areas that have experienced the highest take up rates of furlough in the UK: Eden in Cumbria, Crawley in West Sussex and Haringey in London. In each of these places, the local sector-mix leans towards industries that were heavily impacted by restrictions, and highly reliant on furlough, as seen in the table below.

Table 1: Top sector workforce shares pre-Covid

Source: Cambridge Econometrics, 2021

Cambridge Econometrics latest forecasts project that all three areas will experience a rate of GVA contraction higher than the UK average during 2020 (Haringey is expected to experience a real terms contraction of 10.2%, Crawley 14.0% and Eden 12.3%).

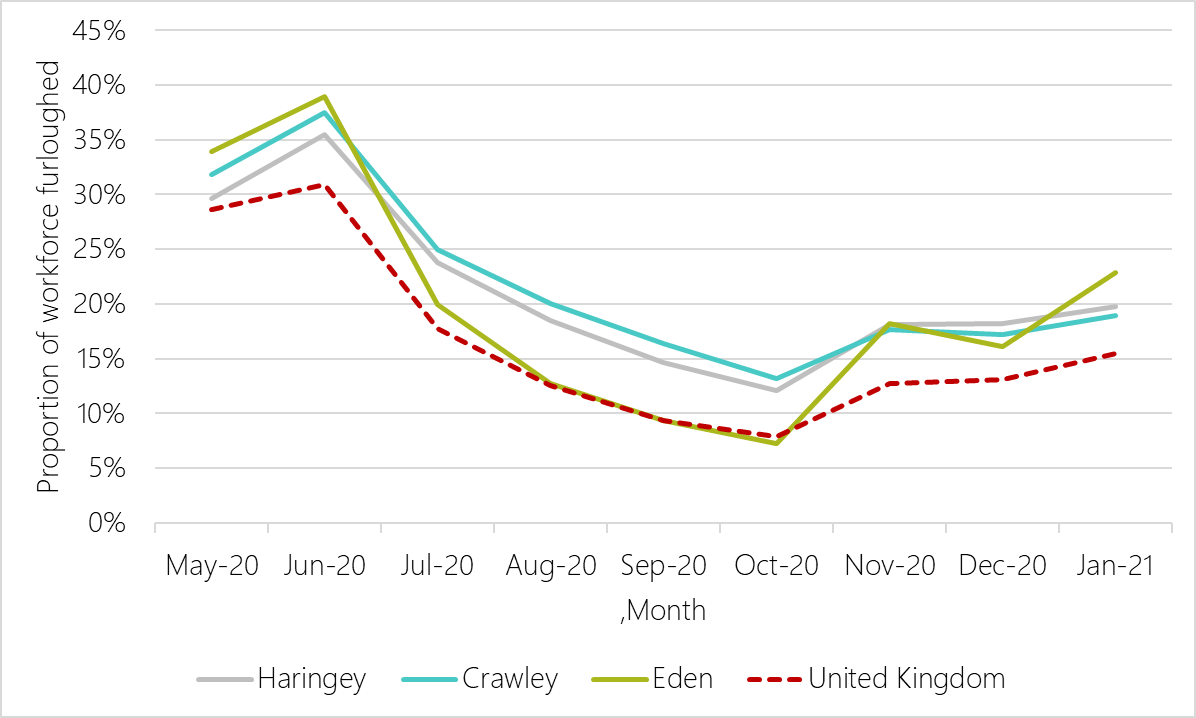

Figure 3: Furlough take-up rate 2020-21 as proportion of all eligible jobs

Source: HM Revenue & Customs (January 2021), Coronavirus Job Retention Scheme Statistics.

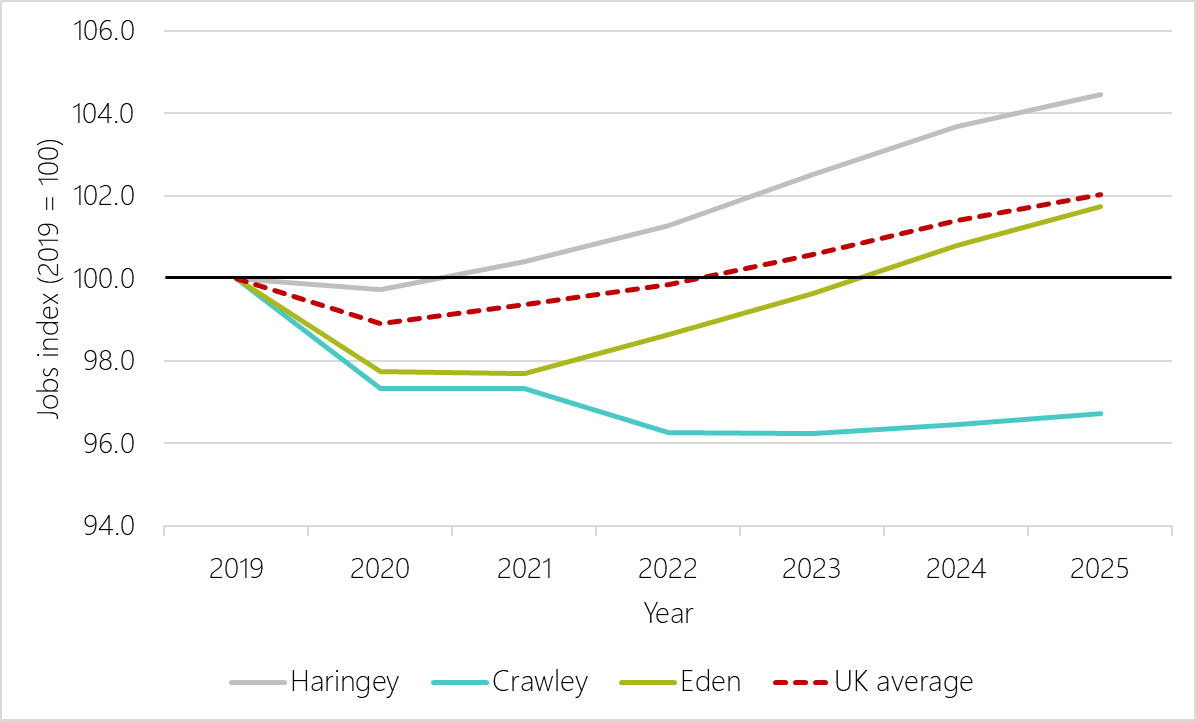

Projections for the coming years show different recovery and job growth rates for these three local areas, with Haringey indicating a potential to show greater resilience than the UK average. while Crawley and Eden are expected to experience significant job losses, and varying recoveries.

Figure 4: Projected jobs recovery to 2025 (baseline 2019)

Source: Cambridge Econometrics, 2021

Haringey – high rates of furlough, but expecting a swift recovery

The longer-term impact of the crisis in Haringey is forecast to be less severe than other parts of the country. This is a result of growing or stable employment in sectors that have been resilient during the crisis, such as education, real estate and media, whilst the borough’s most highly impacted sectors have proved resilient (largely a result of a high and sustained uptake of furlough support).

Haringey’s projected recovery from the crisis is stronger than others due to a favourable sectoral profile, with a good and diverse representation of industries expected to bounce back quickly, particularly those that could benefit from pent-up consumer demand (such as the arts, leisure and retail). Its position in London also plays a role, as the city is expected to recover faster than other parts of the UK.

Crawley – facing significant and prolonged labour market disruption

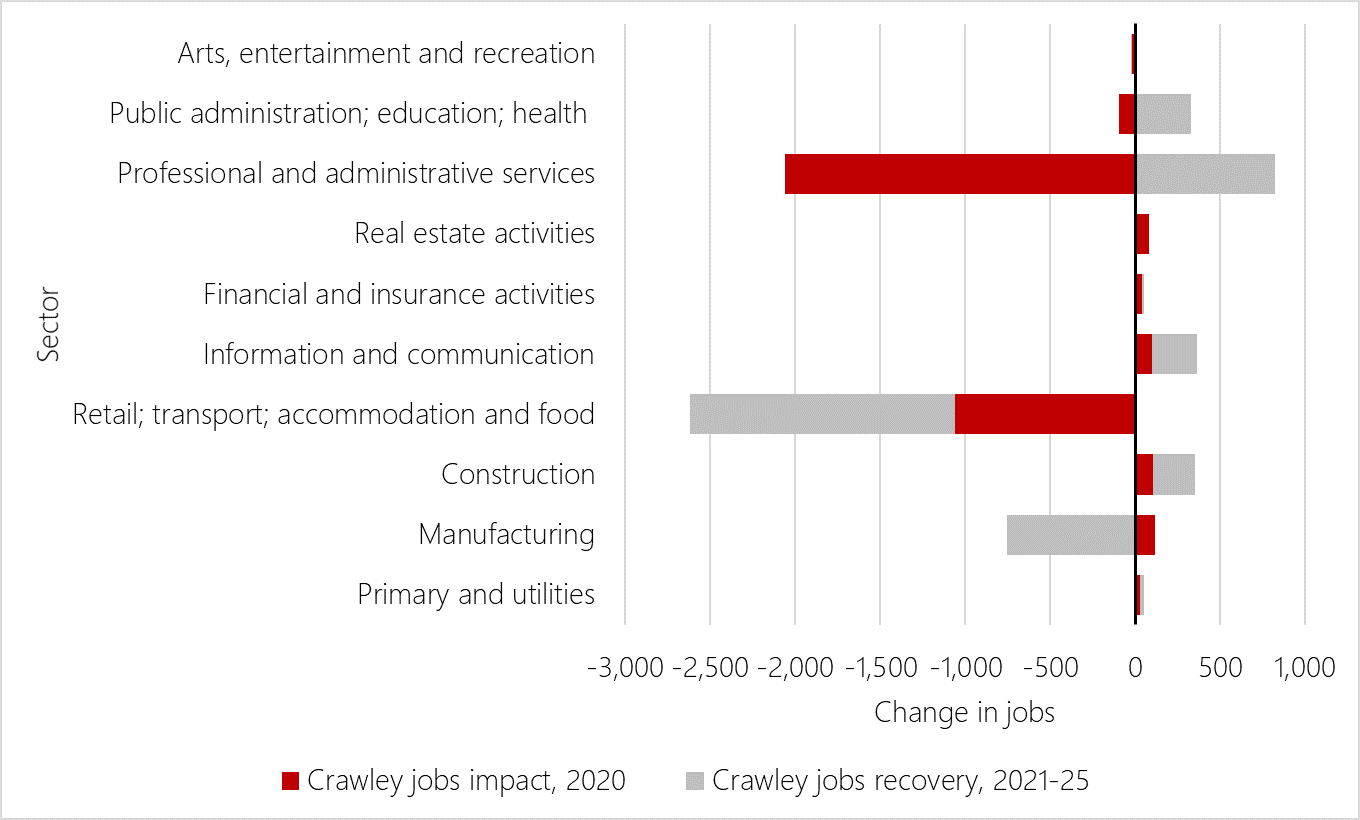

Figure 5: Impact of Covid-19 crisis on jobs in Crawley and projected employment change 2021-25, by sector

Source: Cambridge Econometrics, 2021

Crawley faces a significant and prolonged labour market disruption from the crisis. This is attributable to the large and established aviation sector in the area, centred around Gatwick airport, which isn’t expected to pass pre-Covid levels of economic activity until 2025. The time needed for this sector to recover, and the wider dependence of the area on a set of core sectors which were badly affected by the crisis will contribute to Crawley’s slower recovery. Additionally, recovery in other sectors won’t be sufficient to offset these losses.

Eden – hard-hit visitor economy expecting swift recovery once Covid-19 restrictions end

Eden’s labour market is centred around the vibrant visitor economy of the Lake District and Yorkshire Dales, and is well represented in sectors such as accommodation, food service, retail, and the arts and entertainment. During the summer of 2020, activity in these sectors saw furlough rates drop below the UK average in Eden. And these industries are largely expected to recoup if not exceed their 2020 employment losses during the recovery 2021 onwards, with the accommodation sector expected to create jobs twice as fast as any other sector by 2025.

Going forward, different local impacts and consequences require tailored local responses

This analysis highlights that different local economies and labour markets will have very distinct trajectories out of the crisis. In particular, it is highly likely that the sectoral makeup of local economies and the potential impacts of ongoing restrictions will play a role in the long-term impact of the crisis on different places.

At the local level, it is positive to see areas already outlining their priorities for recovery. The Crawley Economic Task Force and Town Deal Board has been developed in response to the crisis and is working with businesses to design and deliver a range of interventions, including training programmes tailored to the needs of the local economy and strategic investment in the ‘green economy’, which would contribute to the creation of new, high-skilled jobs over the longer term. Given that Cambridge Econometrics are forecasting that the pandemic will have an enduring impact on the local economy, additional structured and intensive employment support may be required over the interim period to support workers affected by supressed demand in air travel.

In Eden, it is forecast that employment in retail and hospitality will likely bounce back quickly due to increasing demand as restrictions ease over summer 2021 and limits on overseas travel remain in place. It is therefore vital that in creating new jobs, businesses are supported to ensure that they are providing high-quality and secure employment opportunities. A longer-term aim should be to further diversify the local economy and improve connectivity to other parts of the North West, which will increase access to a broader range of job opportunities and potentially provide additional resilience against future economic disruptions.

Haringey’s location in Greater London and diverse local economy put the area in a stronger position for recovery, as highlighted in our analysis and echoed by Haringey’s Good Economy Recovery Plan. Nevertheless, even before the pandemic, many who live in Haringey faced significant barriers to accessing well paid, secure work. The Haringey Fairness Commission recently highlighted that the borough has one of the highest poverty rates in London, with more than a third of people living in poverty (33.8%), including in-work poverty, and 25% of workers not earning the London Living Wage of £10.75 an hour. Focussing support on these groups, together with greater investment in training and new job opportunities should be prioritised in sectors that offer security and clear opportunities for career progression.

National policies and funding should enable tailored local responses to recovery

At the national level, plans for recovery should enable support to be tailored to the needs of local areas, supported by the sustained levels of funding that may be required. The anticipated Devolution White Paper provides a clear opportunity for government to connect local recovery with the levelling up agenda in England. Combined Authority and Mayoral budgets should be place-based, multi-year and flexible to genuinely empower local decision makers to respond to the needs of their area effectively.

Covid-19 demonstrated the significant vulnerability, low pay and precariousness of many jobs in the UK – which must now be addressed

Additionally, there is a need to ensure a focus on job quality and security through the recovery, rather than solely focussing on employment levels. The upcoming Employment Bill is an opportunity to improve worker protections in a variety of areas, including increasing Statutory Sick Pay coverage to include those currently earning below the minimum threshold or working variable hours, ensuring more transparent and predictable hours for the most insecure workers, and introducing more ambitious legislation on flexible working.

Disclaimer

The opinions expressed by our bloggers and those providing comments are personal, and may not necessarily reflect the opinions of Lancaster University. Responsibility for the accuracy of any of the information contained within blog posts belongs to the blogger.

Back to blog listing