Is the Chancellor giving with one hand and taking with the other?

Posted on

© Photo from Jeremy Hunt's 'X', formerly known as Twitter

© Photo from Jeremy Hunt's 'X', formerly known as Twitter

In one of the last opportunities to improve working lives before the General Election, the Chancellor, Jeremy Hunt, delivered a ‘back to work’ Autumn Statement and promised to ‘make work pay’.

He announced a headline 2p cut in National Insurance for most workers, increased the National Living Wage and the National Minimum Wage, and uprated benefits in line with September’s inflation.

With the UK still facing worker shortages and record levels of long-term sickness, he also announced further carrot and stick measures to get people with long-term health conditions back to work. This is almost certain to increase uncertainty and anxiety for some of the most vulnerable people in society.

Increase in the minimum wage and cuts to National Insurance will be welcome to many workers

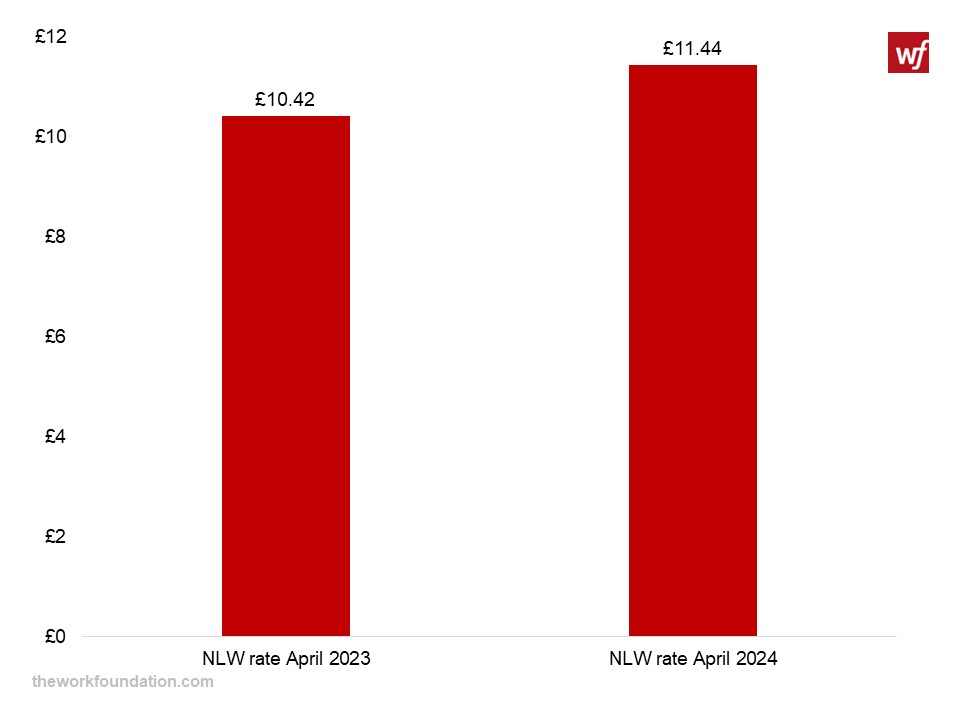

This Autumn Statement provided some welcome news for workers who are struggling with the current cost of living. The Chancellor announced a boost to the incomes of the estimated 1.6 million workers who are on the National Living Wage. This will be increased in April 2024 by 9.8% to £11.44 per hour – up from £10.42 the previous year. As a welcome change, it is being extended to workers aged 21-22 in line with previous plans.

Although this represents a substantial increase, food inflation currently remains above 10% and may remain high into 2024, and energy prices are likely to rise again this autumn. This means that any increase that low paid workers will see in their salaries will likely be swallowed up by the continued high cost of living.

Figure 1: The National Living Wage will increase by 9.8% in April 2024

Furthermore, the minimum wage is often underpaid by employers, with the highest levels of underpayment taking place around the moment the annual increase sets in. The size of this uplift should prompt the HMRC National Minimum Wage enforcement team to actively inform and stimulate employers to implement the increase in a timely manner, as an estimated 21% of minimum wage workers are underpaid and may not see their wages increase sufficiently.

Additionally, National Insurance will be cut by two percentage points for employees earning between £12,571 and £50,270, reducing from 12% to 10%. For self-employed workers, the Chancellor abolished Class 2 National Insurance entirely and reduced Class 4 by one percentage point. This cut will be welcomed by workers struggling with rising prices, but higher paid workers are likely to benefit more than lower paid workers and those who earn below the threshold of £12,570 will miss out entirely.

Against a backdrop of the freeze to income tax and National Insurance thresholds, the Chancellor is giving with one hand and taking away with the other. This means that some workers may slip into a higher tax bracket and may end up paying more tax and end up with lower earnings after these changes.

Tax incentives for businesses – no strings attached

Throughout the Autumn Statement, it was reiterated that one of the five areas that the Government is focussing on as part of their plan to grow the economy is rewarding hard work. But where is the reward for low paid and insecure workers?

While the Chancellor introduced a series of tax allowances to incentivise business investment, these allowances will not come with any requirement for businesses to improve the quality of jobs they offer via increased pay or strengthened terms and conditions for their workers.

The Statement served as a missed opportunity for the Government to embed the prioritisation of creating high quality and secure jobs. Now that businesses have been given the capacity to review their investment strategies, we would like to see them prioritise tackling severely insecure work as part of their economic development.

Those are strings, Pinocchio

Contrary to earlier rumours around benefits cuts, the Chancellor confirmed today that Universal Credit and other benefits will be uprated in line with September’s inflation rate of 6.7%. It is important to note that the UK still has one of the lowest levels of unemployment benefits in the OECD, at just 17% of the recipient's previous income levels.

This uplift comes with strings attached – the threat of sanctions.

The Government is reforming the Fit Note process, the Work Capability Assessment, and introducing mandatory placements or training in a ‘workfare’ type programme after 18 months of unemployment. If then failing to obtain work, job seekers could see their welfare cases being closed, their benefits withdrawn entirely, and their access to wider services such as free prescriptions and legal aid ended.

Our previous research found that disabled workers are already 1.5 times more likely to be in this type of work, for example zero-hour contracts, in a bid to try and obtain the flexibility needed to manage health conditions. The threat of sanctions is likely to push those with long-term health conditions into ‘any job’, rather than one that suits their skills and needs.

As we have highlighted previously, even the Department for Work and Pensions’ own evidence from 2020 suggests sanctions are not effective and slow people’s progress back into work. The reality is these punitive measures will likely only serve to heighten anxiety amongst already very vulnerable people.

So, will these measures improve working lives and support economic growth by increasing workforce participation?

On the face of it, many of the headline measures will be welcomed by employees and employers. The Office for Budget Responsibility (OBR) expects the economy to grow by 0.6% in 2023 and 0.7% in 2024 – down from previous forecasts. Hunt says the OBR forecast that his supply side measures from both the Spring Budget and this Autumn Statement will increase the number of people in work by around 200,000 by 2028. But even if the Government meets these forecasts, will the negative impact on some of the most vulnerable groups in society be worth it?

Related Blogs

Disclaimer

The opinions expressed by our bloggers and those providing comments are personal, and may not necessarily reflect the opinions of Lancaster University. Responsibility for the accuracy of any of the information contained within blog posts belongs to the blogger.

Back to blog listing