The calm before the storm: New ONS labour market data reveals scale of the unemployment crisis to come

Posted on

© Photo by Andrew Gook on Unsplash

© Photo by Andrew Gook on Unsplash

The latest labour market data gives an early indication of the challenges ahead. With very limited vacancies, a large number of people on furlough and a sharp rise in those without a job who aren’t looking for work, we can see the emerging conditions for a troubled autumn when the Coronavirus Job Retention Scheme (CJRS) winds down in October.

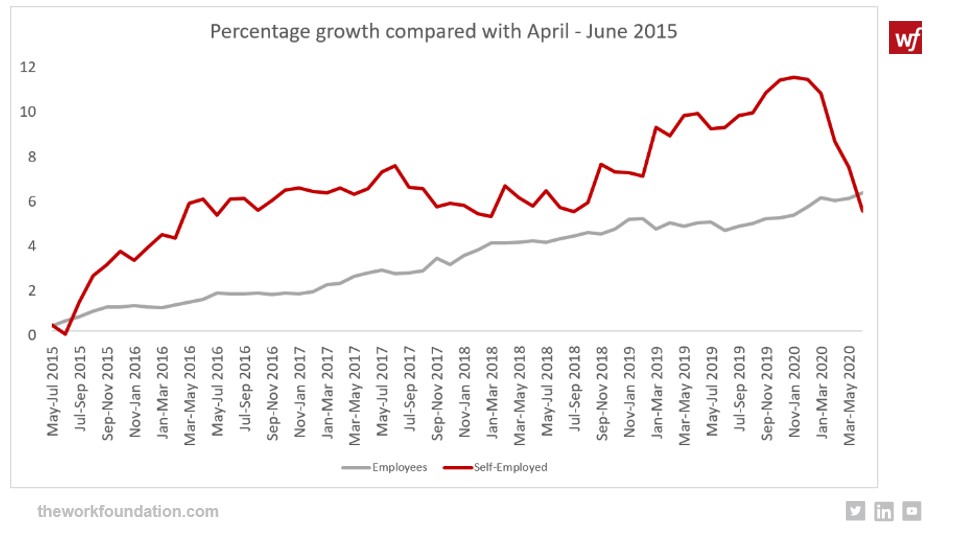

This month’s release shows a decrease in self-employed workers, down by around 238,000 compared with the previous quarter.

Figure 1: Percentage growth in numbers of employees and self-employed

Source: Data: ONS labour market

However, while the April-June Labour Force Survey (LFS) shows 52,000 new employees, the flash estimate from HMRC’s PAYE real time data, shows around 700,000 fewer workers on payroll in July 2020 compared with the previous quarter, which paints a considerably worse picture. It is likely that these figures will be reflected in the LFS statistics over the course of the next quarter.

This month’s employment and unemployment figures are stabilised by the job retention scheme. 7.5 million people are temporarily away from work, and nearly half of them haven’t worked for more than three months, reflecting high usage of the scheme. Some of those who are ‘temporarily away’ from work now are likely to shift into unemployment or inactivity over the coming months.

This quarter alone, redundancies increased by 25%. On top of that, 1,778 UK firms are already planning to cut 139,000 jobs according to new data from the Insolvency Service. As only companies making 20 or more redundancies are obliged to report this formally, the real number will likely be much larger.

It is particularly concerning that some of those who are temporarily away from work will receive no income during that time. This month’s labour market data indicates that nearly 230,000 self-employed workers who are currently away from work are not eligible for the Self-Employment Income Support Scheme. A further 417,000 employees away from work were not paid at all in June. According to the Wealth and Assets Survey households where the main earner works in a low paid sector are more likely to struggle to manage a month with no income. For example, an estimated 35 to 50% in sectors such as accommodation and food services or wholesale and retail lack the financial resilience to cover that period. This proportion goes up the longer the situation endures.

As a ‘V-shaped’ recovery looks now increasingly unlikely, there are particular groups of people that will struggle to cope and will require additional support, particularly given the lack of job vacancies in the economy, which is now lower than it was during the height of the financial crisis. While there was a slight uptick in vacancies between June and July, the overall number is still much lower than the previous quarter, and shows a decrease of approximately 56% on the same period last year. This means fewer people can move into new jobs, which factors into the decreasing employment numbers.

Figure 2: Number of vacancies

Source: Data: ONS labour market

As seen in previous recessions, an increasing number of working people are moving into ‘inactivity’, meaning they aren’t currently looking for work. People may have all sorts of reasons for this, but the current increase in inactivity is likely related to the continuing low number of vacancies, with some sectors experiencing stronger reductions and recovering more slowly than others. Furthermore, households with limited access to childcare provision may not have been in a position to start looking for work.

The largest increase in inactivity is driven by those who are aged 16 to 24 years old, which raises concerns for young people’s future labour market prospects. A previous WF blog notes that when young labour market entrants are unable to find work, this can have long-term ‘scarring’ effects. However, the Government is planning to invest in this group with the £2bn Kickstart Scheme, which will provide up to 300,000 six-month work placement opportunities. Additionally, the Government will offer a £1,000 incentive for employers who take on a trainee.

On the whole, this month’s figures give the impression of a calm before the storm. It is essential that those affected by the crisis are provided with an adequate level of financial support, and that those falling through the gaps of the temporary measures intended to mitigate the impacts of COVID-19, are given greater consideration as the Government develops longer term plans.

The upcoming Comprehensive Spending Review and autumn budget will provide opportunities to improve and reinforce social security, develop a strategic plan for supporting those who are in a position to work in to employment, as well as stimulate creation of new jobs to improve the range of opportunities available.

Related Blogs

Disclaimer

The opinions expressed by our bloggers and those providing comments are personal, and may not necessarily reflect the opinions of Lancaster University. Responsibility for the accuracy of any of the information contained within blog posts belongs to the blogger.

Back to blog listing