Treading water: ONS data shows increasing labour market insecurity

Posted on

© Photo by Chloe Evans on Unsplash

© Photo by Chloe Evans on Unsplash

This month’s ONS labour market figures show signs of labour market becoming more insecure. Despite levels of unemployment remaining relatively stable, a host of other indicators across vacancies, hours worked and wages, reveal a labour market that is suffering severe contractions due to COVID-19, with substantial unemployment likely to emerge later in the year.

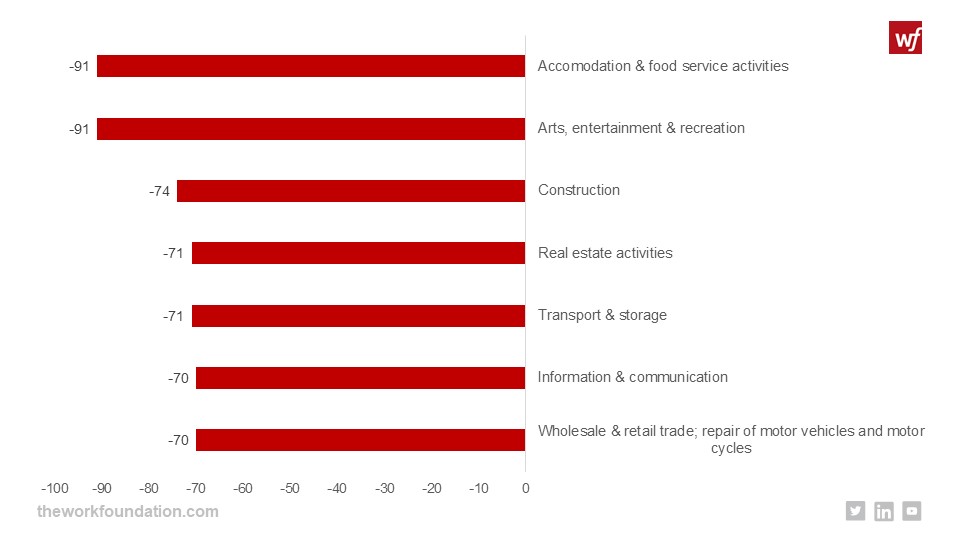

Heightened labour market insecurity shows itself in the reduced number of job vacancies. Between April and June this year, vacancies more than halved (-58%) compared with the previous quarter. In sectors such as accommodation and food services and arts, entertainment and recreation, which furloughed over 70% of workers, vacancies have declined by over 90%.

Figure 1: Percentage decline in vacancies for sectors where vacancies declined by 70% or more

Source: ONS Labour market overview - July 2020

When prospects for securing new work are reduced, this has implications for out of work job seekers, as well as those who are currently in work. This picture is made more alarming in light of recent evidence from the British Chamber of Commerce, which found that 29% of the 7,400 surveyed businesses plan to make job cuts over the next three months. Already, large retailers such as Boots and John Lewis have announced thousands of job cuts in recent days, losses not included in the figures released today.

The current lack of vacancies has driven this month’s decline in employment numbers rather than redundancies, due to fewer people moving into new jobs. In addition, larger numbers of people are moving into inactivity, meaning they do not have work and are not looking for work. There is a striking shift in reasons for being inactive, with a sharp increase in feeling ‘discouraged’ and in ‘wanting a job, yet not actively looking’. Simultaneously, those currently in work may also be affected by the declining number of vacancies, which will limit their room for maneuver should their employer reduce their hours or pay in order to cut costs.

This kind of strain is already being felt by workers now. Today’s release reveals hours worked reduced by 20% over the last quarter. This substantial fall is mostly due to uptake of the Job Retention Scheme (JRS), yet many employers may also have been cutting hours for staff that have remained in their posts during the lockdown — to reduce costs and increase the possibility that these jobs can be kept in the longer term.

The self-employed have seen a particularly large decline in the hours worked — 29% over the last quarter. Given that we have also seen a record quarterly reduction in the volume of self-employed workers in the labour market, this is clearly a group that has been hit hard by the crisis. The extent to which the self-employed will be able to bounce back as lockdown is further eased remains to be seen and will vary by occupation. It is more likely that sole trader builders will be able to resume activity than self-employed caterers, for example.

This quarter also sees pressure on wages increase, with real pay down by £6 since the previous quarter. Worryingly, we see declines in pay focussed in particularly low paid sectors, such as retail and accommodation and food services. This is partly related to reductions in hours worked, and partly due to furlough, as the majority of workers received only 80% of their usual salary through the JRS.

Figure 2: Percentage difference in earnings between May 2020 and May 2019, by sector

Source: ONS (2020) Dataset: EARN03 - Average weekly earnings by industry, non seasonally adjusted

We know that workers in low paid jobs disproportionally struggle to manage periods of reduced income and tend to rely on savings or credit to manage financially. This has implications both for people’s ability to spend in the near future, and thereby the recovery of consumer demand, as well as severely diminishing household’s financial resilience the longer the crisis lasts. And as we have noted, pressures on workers and households will increase further once the JRS winds down in October, with further redundancies likely to follow.

Much uncertainty remains over the future direction of the public health crisis, and the potential for a swift economic recovery. GDP figures released earlier this week suggest the hoped for ‘V shaped recovery’ is unlikely to materialise, and we expect to see more of the unemployment impacts of the crisis to come to the fore over the autumn and winter. Yet as support measures like the JRS wind down, it seems Government is banking on a swift pick-up in consumer demand to stem economic decline and protect jobs. Given we may yet see a second wave of COVID-19 as the lockdown continues to ease, it is likely that increased insecurity will become an enduring feature of the labour market for many workers for the foreseeable future.

Disclaimer

The opinions expressed by our bloggers and those providing comments are personal, and may not necessarily reflect the opinions of Lancaster University. Responsibility for the accuracy of any of the information contained within blog posts belongs to the blogger.

Back to blog listing