UK labour market sees steep increase in unemployment

Posted on

Today’s labour market data covering September to November 2020 shows the impact of the second national lockdown on an already slow recovery. Unemployment is the highest it has been since 2016, and vacancies remain low. Redundancies, although down from their peak in September, remain high. Overall there is little improvement this quarter, and no indication the labour market situation will improve any time soon in the context of the third national lockdown we are currently navigating.

Unemployment

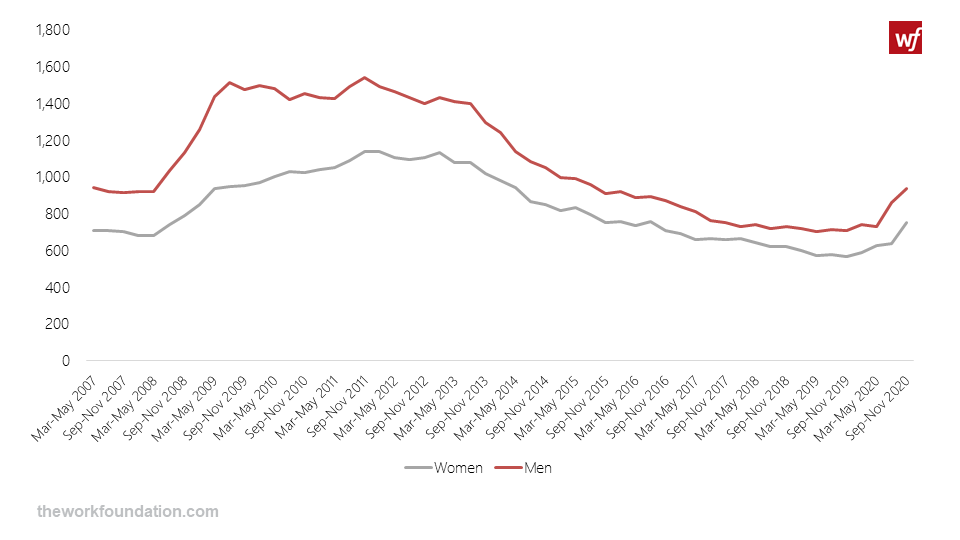

Unemployment is the highest it has been since January-March 2016. The numbers rose steeply this quarter (by 202,000) bringing the rate up to 5%. This is driven particularly by an increase in unemployment among women (116,000 this quarter), compared with 74,000 men.

Overall inactivity levels, referring to those who are out of work and not currently looking for work, such as discouraged workers or homemakers, are higher than last year, but slightly decreased on the quarter. The Bank of England considers this due to workers who were made redundant over summer looking for a job over the autumn. The ongoing tightening of the labour market, with limited opportunities to find new employment, means that people move from inactivity to unemployment as they start looking for jobs.

We see this particularly for women. In the years prior to the pandemic, we have witnessed a steady flow of women moving out of inactivity and entering employment, reflecting increasing labour market participation of women. Although the number of inactive women continued to fall this quarter (98,000), employment numbers contracted too, and so for the first time we see women composing the largest share of the group of newly unemployed people, reflecting both the effect of redundancies and slow recovery of sectors in which women are overrepresented.

Figure 1: Unemployment level 2007-present, by gender

Redundancies and vacancies

Redundancies increased between September and November 2020 by a record 280,000 on the year, and 168,000 on the quarter, to a record high of 395,000.

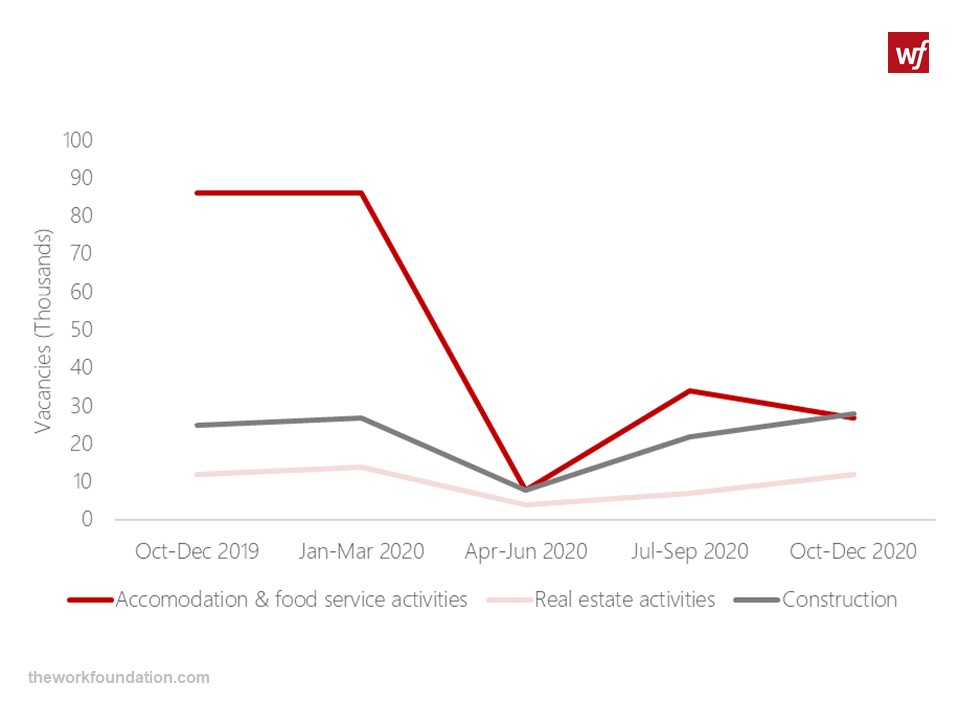

Vacancies continue to lag, although between October and December 2020 vacancies increased slightly by 81,000 to an estimated 578,000. Hospitality (accommodation and food services) was the worst affected sector this quarter, with vacancies decreasing by 21.5% on the quarter to 27,000. This sector has been the hardest hit over the course of the pandemic so far, with a 69.5% (-59,000) drop in vacancies compared to the same quarter in 2019.

Figure 2: Vacancies by sector, Oct-Dec 2019 – Oct-Dec 2020

On the other hand, vacancies in real estate increased by 59.5% this quarter, bringing them back to pre-pandemic (Oct-Dec 2019) levels. This can likely be attributed in part to the temporary cut in stamp duty, although this policy is due to come to an end on 31st March 2021. The construction sector is doing similarly well, with 28,000 vacancies, an increase of 8.3% on the year.

According to recent analysis from The Bank of England, the number of applications from unskilled and junior staff increased between October and December 2020. This can be attributed to the fact that sectors that usually absorb these workers, for example hospitality, have been affected by public health measures causing temporary closures.

The number of hours worked are still low, but are steadily increasing, though presumably the increased use of furlough during the November lockdown is slowing that recovery (Opinions and Lifestyle Survey). The main gains in hours can be seen among those working 31-45 hours a week. This is consistent with the reduction in part-time work from the onset of the crisis, with the number of part time workers falling by 636,000 since Jan-March 2020.

Compared with the impact of the Covid-19 crisis on economic activity in many sectors, the impact on employment remains muted, due in large part to Government support measures such as furlough. Considering the policy’s success in buffering the labour market, it is important to avoid a cliff edge when the scheme ends. It is likely some restrictions will remain in place beyond spring and will continue to impact business activity. This requires careful handling by Government, for example through advance notice to businesses, and a staggered, or phased reduction. For example, reinstating local furlough for affected areas and sectors could help with this.

Furthermore, today’s figures do not speak to the impact the crisis has had on household finances, which we have explored previously. The reduction in earnings due to furlough, unemployment and cut backs in hours have fallen disproportionately on low income households and many have had to claim Universal Credit for the first time. Government should reverse plans to cut essential Universal Credit payments by £20 per week and remove the threat of sanctions for those looking for work in these challenging circumstances.

Disclaimer

The opinions expressed by our bloggers and those providing comments are personal, and may not necessarily reflect the opinions of Lancaster University. Responsibility for the accuracy of any of the information contained within blog posts belongs to the blogger.

Back to blog listing