How did working hours and earnings change during the lockdown?

Posted on

© Photo by Stephen Dawson on Unsplash

© Photo by Stephen Dawson on Unsplash

COVID-19 has brought unprecedented upheaval to the UK economy, and today’s ONS labour market data gives an early indication of what that means for hours, earnings, and jobs. Statistics reported here cover the three months to the end of April 2020 and include the first 34 days of the UK lockdown, which started on 24th March.

In terms of employment and unemployment levels, we have yet to see much volatility in this quarter be reflected in the data. Overall employment rates declined by 0.1% to 76.4% compared with the previous quarter. Unemployment levels remained unchanged at 4.0%. However, we see early indications of the impact of the lockdown through an unprecedented decline in hours worked and a 60% decline in vacancies.

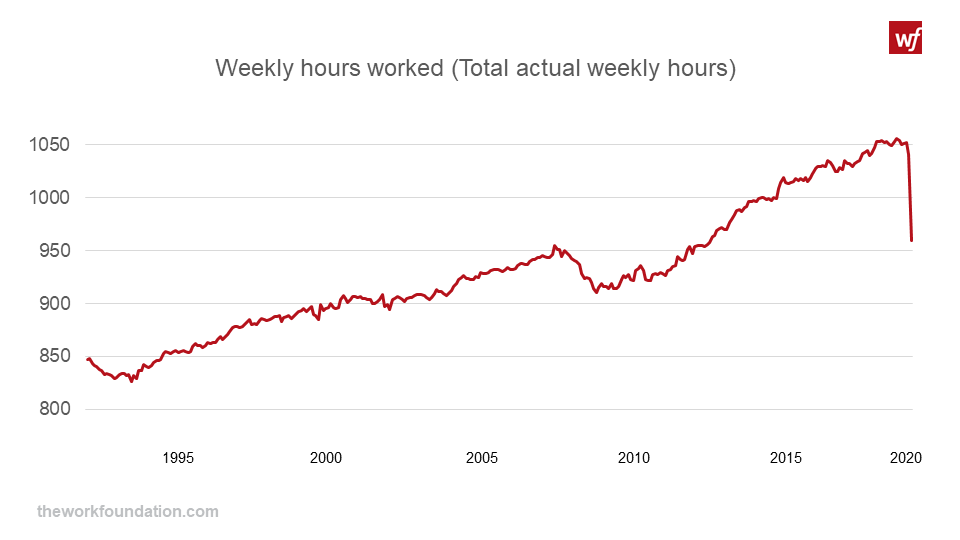

In terms of hours worked, we have seen a record drop across the board. This reflects high take up of the Coronavirus Job Retention scheme alongside others being able to stay in work but needing to reduce their hours.

There were particularly steep declines for part-time workers of 12.2% compared with 8.8% amongst full time workers. Amongst the self-employed, hours have declined overall by 2.7%, but this conceals a very polarised picture. We are seeing a 16.6% increase in those working 6 hours or less a week and a large decrease in those working 16 hours and over, which implies an associated reduction in earnings and greater insecurity for these workers.

Source: ONS Labour Market Update, 16/06/20

Source: ONS Labour Market Update, 16/06/20

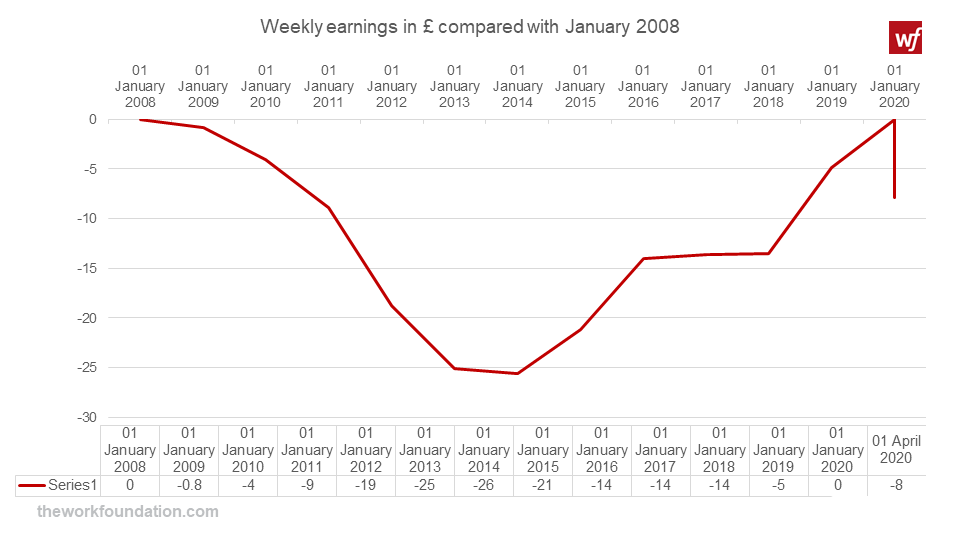

In terms of pay, the crisis is already leading to declines in earnings, at a time when wages had only just recovered to levels seen prior to the 2008 financial crisis. Real weekly pay has fallen by £7 compared with the previous quarter. Sectors where wage growth has been strong over recent years, like finance, are now seeing that growth taper off. In sectors that previously saw weaker pay growth, such as construction and retail, or hotels and restaurants, this has now stagnated or become negative.

Source: ONS Labour Market Update, 16/06/20

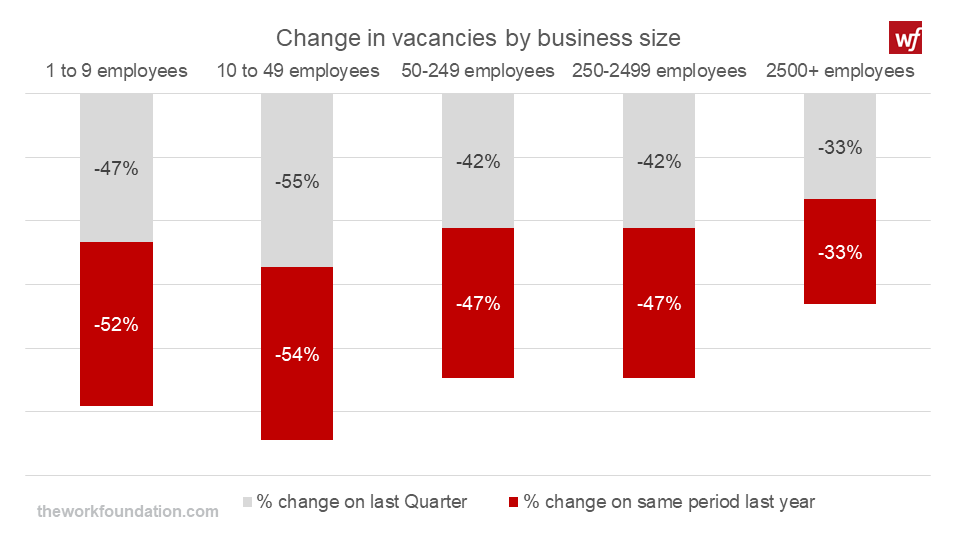

The latest update sees an unprecedented 42% decline in vacancies. Sectors most affected by the lockdown, such as accommodation and food services saw large declines in vacancies (down 70% on the previous quarter). Construction, wholesale retail and trade, transport and storage all saw a more than 50% reduction in vacancies over the spring.

Where job vacancies become limited, worker mobility is reduced and the likelihood of workers accepting a greater degree of insecurity and poor working conditions increases. This is concerning particularly for workers in the hardest-hit sectors like retail, accommodation, and food services which were already characterised by insecure and low-paid work.

Despite targeted Government support for SMEs, vacancies declined most steeply in smaller businesses with between 10-49 workers, falling by 56% from the previous quarter. A business survey by the Chamber of Commerce, of which 75% are SMEs, showed that by mid-May, 70% of businesses had furloughed some staff and 15% had furloughed their entire staff. There is however a lot of sectoral variation. For example, the Business Impact of Coronavirus Survey, covering a two-week period of 4th -17th May, found that 97% of food and accommodation businesses had furloughed staff. Other sectors with a high proportion of businesses indicating they had made use of the Job Retention Scheme were transportation and storage (88%) and wholesale and retail trade (80%). Source: ONS Labour Market Update, 16/06/20

Source: ONS Labour Market Update, 16/06/20

We won’t know the full extent of the labour market impacts of the crisis until later this year, when the furlough scheme has wound down and data becomes available for the full duration of the crisis. In the meantime, today’s release gives an early insight into the potential direction of travel. It suggests that while take up of the Job Retention Scheme is temporarily sustaining employment rates, a series of problems lie beneath the surface. Reductions in earnings and hours alongside a sharp fall in vacancies all suggest that employers have been struggling to manage over recent months, even with the support available.

As the economy re-opens, the Government may need to consider where more targeted support may be required over the medium to longer term, including looking at the needs of specific sectors and of smaller firms.

Disclaimer

The opinions expressed by our bloggers and those providing comments are personal, and may not necessarily reflect the opinions of Lancaster University. Responsibility for the accuracy of any of the information contained within blog posts belongs to the blogger.

Back to blog listing