Brexit negotiations increase uncertainty in UK house prices, signalling slowdown in prices in 2019

-636789350388522425.jpg?mode=crop&width=874&height=289¢er=0.52%2c0.48)

The growth rate of house prices is likely to keep falling in 2019 because of uncertainty following Brexit negotiations, experts from Lancaster University warn.

A new tool developed by the UK Housing Observatory, based at Lancaster University, reveals uncertainty in the UK housing market has increased by 50 per cent over the last six months, signalling a risk to the housing market and overall performance of the country’s economy.

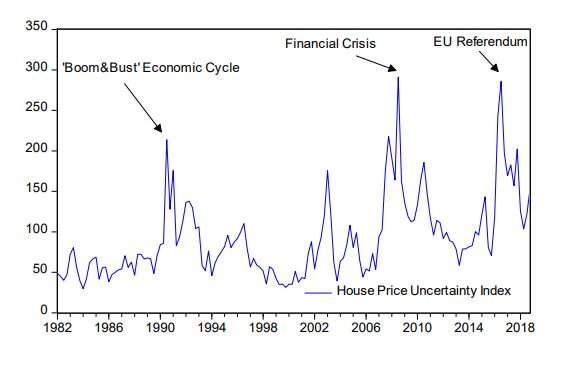

The Observatory has been monitoring house prices in the UK for several years. The House Price Uncertainty (HPU) is a newly created index based on counts of articles from five major newspapers in the UK from 1982-2018 that contain terms relating to house prices and relevant policies.

The HPU index reached one of its highest ever points immediately after the referendum in 2016, showing Brexit’s impact on uncertainty within the housing market, and has remained high ever since.

However, over the last two quarters, the house price uncertainty (HPU) index has increased by an incredible 50%. Records from the UK Housing Observatory show that, historically, the highest levels of uncertainty occurred ahead of economic recessions (1990-91 and 2008-09), followed by the second-ever highest value right after the EU referendum.

While the index dropped during the first half of 2018 to a value close to 100, it has started rapidly increasing in the second half of the year, standing at 155 today. Something expert analysis explains by uncertainty generated by the domestic political situation, the negotiations with the EU about the withdrawal agreement, and the outcome of Brexit and its consequences.

Professor Ivan Paya, one of the directors of the UK Housing Observatory at Lancaster University Management School, said: “All these factors have continued to intensify uncertainty in the UK housing market which is expected to have real consequences – not only on the market itself but on the overall economy.

“We anticipate this recent increase will have a negative effect on UK prices over the next few quarters. All this uncertainty has already had an impact. We have experienced lower rates of growth in house prices since the EU referendum took place. The UK national index grows at levels of only around 2% relative to levels above 5% before the referendum.

“Moreover, in regions such as London, where prices are more dynamic, they have experienced negative growth rates over the last year, while prices were growing at around 10% before the referendum.”

The UK Housing Observatory was set up by the Economics department at Lancaster University Management School (LUMS), with the aim of improving the understanding of UK national and regional housing markets. The team provides a comprehensive publicly available set of information and tools to perform real-time monitoring of domestic real estate markets both at the national and regional level.

Back to News