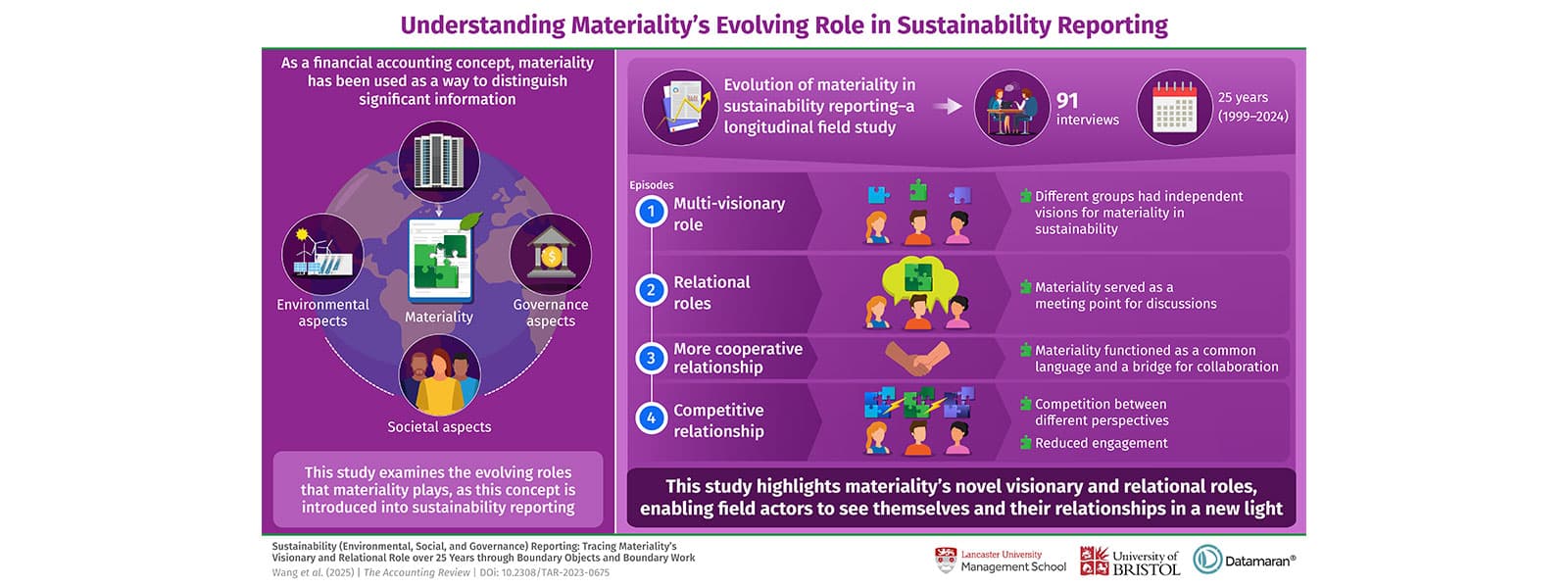

In financial accounting, materiality is considered as a way to distinguish significant information so that reporting entities, information users, and auditors can avoid spending too much time on the items that do not matter.

However, since its introduction into sustainability reporting, this concept of materiality has expanded significantly and has taken different shapes and forms, leading to much debate about its exact role. In a new study published in the accounting review, researchers explored materiality's evolving role over the last 25 years in four interconnected episodes of sustainability reporting, drawing from 91 interviews with a wide range of professionals, including many policy makers and standard setters.

In the first episode, materiality emerged as a broad and flexible concept. Different organisations, policy makers, and industry leaders saw its potential to improve sustainability, reporting, risk management, or corporate governance, and use this concept in their own way. Materiality acted as a multi-visionary object, accommodating diverse perspectives without triggering much debate between groups with different perspectives. At this point, in the second episode, materiality shifts to a point of debate. Previously, groups focused on their own interpretations of materiality, but now they began to pay greater attention to the perspectives proposed by others as they sought to define materiality in ways that represented their own viewpoints and interests. Different groups have points of divergence around how to define the concept of materiality and the 2x two materiality matrix. However, despite such differences, materiality functions as a meeting point where groups could discuss and understand each other's varied perspectives.

In the third episode, materiality evolved into a common language and building bridges, which gave a sense of unity and connectivity, inspiring different groups to prioritise collaboration over competition, at least temporarily. Recognising the need for collaboration, businesses and regulators work toward integrating financial and impact materiality into a more comprehensive approach, which acknowledges both perspectives and offers a more holistic way to look at sustainability in ESG issues. However, by the fourth and most recent episode, materiality has become a source of division. The debate over its definition has intensified, with some groups using it as a moral stance while others withdraw from discussions altogether. Instead of fostering collaboration, materiality has begun to serve as a divisive institutional object, highlighting ideological differences rather than bringing groups together. Ultimately, the study reveals that materiality is not just a technical tool for sorting corporate ESG information. It plays a critical role in shaping sustainability discussions at the policy level, influencing the way a broad range of policymakers and professionals see themselves and their relationships to others. While it once helped unify different perspectives, it is now contributing to fragmentation.

As sustainability reporting continues to evolve, the study offers a range of suggestions which have the potential to alleviate the tensions currently in the materiality debate and thus paves the way for the beginning of a re-engaged relationship between these groups when the next episode of Sustainability Reporting arrives.