Manifesto Check: Conservatives convince on cutting the deficit but the price may be growth

17 March 2015

With the most rapid deficit reduction programme, the Conservatives will struggle to achieve economic growth, says William Tayler, of the School’s Economics Department.

The Conservative manifesto commits the party to an additional round of austerity. This will be accomplished with a further £30 billion of spending cuts with the aim of generating a balanced budget by 2017-2018 and a surplus in 2018-2019.

The party’s view is that a balanced budget should be reached quickly with an emphasis on cuts to public spending. As a result they are proposing the most rapid deficit reduction programme of the three main parties. While their approach appears to provide a simple “quick fix” that will restore public finances, the least painful way of reducing budget deficits and public debt is slowly, using policies which promote (or at least limit the fall in) economic growth.

Growth, in turn, reduces the deficit by increasing tax revenues and reducing welfare spending, while lowering the current stock of debt as a proportion of GDP. Faster deficit reduction, through rapid austerity measures, has the opposite effect since it reduces the income of consumers, who then spend less. This then further reduces economic growth and limits its effectiveness as a deficit and debt reducing strategy. Given the low cost of government borrowing and the current limitations of monetary policy to stimulate aggregate demand, an easing of the pace of austerity may be preferable.

Behind the rose-tint

The party boasts to have successfully halved the inherited budget deficit and restored confidence in the UK economy. They point to the 1,000 jobs a day being created and forecasts of seeing a fall in debt to GDP this year. While employment levels have shown significant improvement, other measures of economic performance paint a less rosy picture of the state of the UK economy than the party’s opening comments in their manifesto.

For example, the considerably persistent fall in real wages during the last parliamentand productivity per hour worked remaining at around 16% lower than pre-crisis levels. Admittedly, a large proportion of these falls are a hangover from the financial crisis and the prolonged recession in the eurozone. But the Office of Budget Responsibility estimate that austerity reduced GDP by 2% between 2011 and 2013.

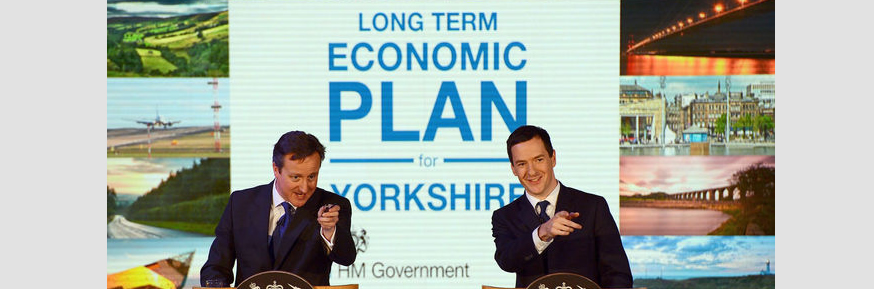

With wages and productivity low, the manifesto’s claims to support policies “that grow the economy as a whole, generating new jobs and higher wages for everybody” are welcome. Elsewhere, they propose an agenda to build a “northern powerhouse”, alongside improvements in both transport and communication infrastructure. If implemented these policies will have positive multiplier effects and generate improvements in private sector productivity and growth to the poorest areas of the country which have suffered the most from austerity.

But the magnitude of this investment is severely limited by the planned austerity measures, which according to the 2014 autumn statement would leave spending at just 1.2% of GDP by 2017-2018. Unlike the other main parties, this would not allow room for the government to borrow for additional public investment. This leaves us questioning the Conservatives' ability to grow the economy with their commitment to austerity and balancing the budget.

Finally, the Conservatives are committed to an EU in-out referendum. Naturally this increases the possibility of an EU exit for the UK. Risking the trade links and positive impact of EU migration poses a threat to economic growth, which would either increase the required level of austerity or hamper their ability to reduce the deficit.

Image Ben Fisher/GAVI Alliance | CC BY-2.0

This article was originally published on The Conversation. Read the original article.

| Follow the discussion via The Conversation comments |

Disclaimer

The opinions expressed in our Comment and Analysis articles and in any attached comments are personal, and may not reflect the opinions of Lancaster University Management School. Responsibility for the accuracy of the information contained within these articles resides with the author.

William Tayler does not work for, consult to, own shares in or receive funding from any company or organisation that would benefit from this article, and has no relevant affiliations.