Gas will replace oil in the UK – with or without fracking

06 February 2015

Fracking might be unpopular with the public and many politicians but gas is still a good bet, says Mark Shackleton, writing in The Conversation.

MPs in the UK recently voted against a moratorium on hydraulic fracturing but Lancashire, the local county council under most pressure, agreed it needed more time to make a decision. MPs also agreed that sensitive areas should be excluded, ruling out many of the UKs shale areas.

The Environmental Audit Committee concluded that development was still some way off and that under the Climate Change Act, emissions from this source should fit within Britain’s 2020 obligations. Since coal-fired stations will cease under EU directives with or without fractured gas, the Tyndall Centre concluded that Britain’s reserves of shale gas might be unburnable under carbon dioxide targets.

With public concerns still unmet, any rationale appears less favourable; however the underlying factors have changed little.

Oil futures

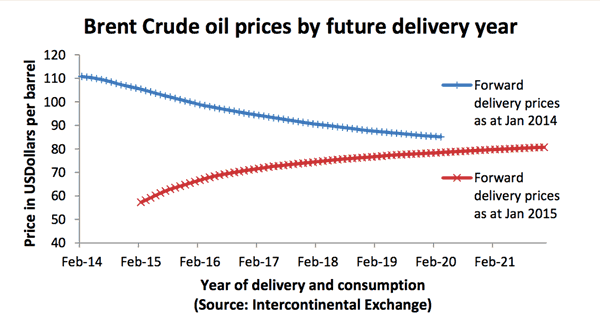

Between January 2014 (blue on chart) and January 2015 (red), the spot price of oil for immediate delivery fell more than 50% from above $100 to near $50 per barrel. However the price of oil for future delivery (in the centre region, say from 2017) has fallen only 30% from about $95 to $65.

Longer horizon prices of oil (on the right for 2020) remain around $80 per barrel; these prices are much less variable and offer better indicators of future demand, the need for supply and the pressures that balance the two.

Thus the current situation of “contango”, with spot or immediate prices lower than those on the longer horizon (upward sloping red curve), is indicative of a short term oil glut that is not expected to persist.

Oil and gas production from the North Sea is declining. Until new energy forms and generation such as renewables can catch up, other domestic sources will be necessary or the UK will have to import more from overseas – further increasing its exposure to world market prices.

With its offshore experience, the UK has a good track record on drilling and recovery and a skilled labour force. The level of environmental scrutiny and remediation is increasing for used oil rigs. Sharing this expertise with shale well developments would partially address the environmental issues; certainly it is more appropriate to have greater scrutiny of onshore work. Compared to offshore, the environmental risks of fracking are concentrated in the first year, after which residual issues are lower compared to oil platforms which need removal.

Unions see the strength of this. Alongside continuity of employment and training, they have also made the case for new energy projects to be located domestically rather than in developing countries where there may be easily accessible energy but poor protections for workers and residents.

Flexible fuel

In the longer run renewables will make the biggest change. However sun, wind and waves are intermittent sources without storage mechanisms for that calm winter night so complementary forms of generation are likely to be required. Gas is the most flexible of fossil fuels; it is already widely liquified for transport and import but when piped into homes for heating, it can also be used for electricity generation via Stirling engines or fuel cells which can also power cars instead of petrol.

If fracking is to make a positive impact within tough carbon budgets, its gas will have to be used more efficiently and creatively than before. Rather than burning it in power stations, its biggest contributions could be to generate electricity in the home (with the heat as a by-product) or in car transport (replacing petrol and oil imports).

If home and car owners have incentives to adapt their energy usage in these ways, gas will prove the transition fuel that many seek.

![]()

This article was originally published on The Conversation. Read the original article.

Image Tim Evanson | CC-BY-SA-2.0

| Follow the discussion via The Conversation comments |

Disclaimer

Mark Shackleton does not work for, consult to, own shares in or receive funding from any company or organisation that would benefit from this article, and has no relevant affiliations.

The opinions expressed in our Comment and Analysis articles and in any attached comments are personal, and may not reflect the opinions of Lancaster University Management School. Responsibility for the accuracy of the information contained within these articles resides with the author.